|

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF

THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

|

|

|

|

|

|

|

|

|

Onto Innovation Inc.

(Name of Registrant as specified in its charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box)all boxes that apply):

No fee required.

Fee paid previously with preliminary materials.

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PROXY STATEMENT

TABLE OF CONTENTS

This proxy statement contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Act”) which include those concerning Onto Innovation’s business momentum and future growth; acceptance of Onto Innovation’s products and services; Onto Innovation’s ability to both deliver products and services consistent with its customers’ demands and expectations and strengthen its market position; as well as other matters that are not purely historical data. Onto Innovation wishes to take advantage of the “safe harbor” provided for by the Act and cautions that actual results may differ materially from those projected as a result of various factors, including risks and uncertainties, many of which are beyond Onto Innovation’s control. Such factors include, but are not limited to, the following: variations in the level of orders, which can be affected by general economic conditions; seasonality and growth rates in the semiconductor manufacturing industry and in the markets served by Onto Innovation’s customers; the global economic and political climates; the impact on supply, production, sales and delivery of our products and services due to the global spread of the coronavirus (COVID-19); difficulties or delays in product functionality or performance; the delivery performance of sole source vendors; the timing of future product releases; failure to respond to changes in technology or customer preferences; changes in pricing by Onto Innovation or its competitors; Onto Innovation’s ability to leverage its resources to improve its position in its core markets, to weather difficult economic environments, to open new market opportunities and to target high-margin markets; the strength/weakness of the back-end and/or front-end semiconductor market segments; the imposition of tariffs or trade restrictions and costs, burdens and restrictions associated with other governmental actions; the ability to successfully complete the integration of the businesses of Rudolph and Nanometrics and to maintain the anticipated synergies and value-creation contemplated by the merger of Rudolph and Nanometrics within the expected time frame; unanticipated difficulties or expenditures relating to the completion of integration of the Rudolph and Nanometrics businesses; and the response of business partners and retention as a result of the merger. Additional information and considerations regarding the risks faced by Onto Innovation are available in the Company’s Annual Report on Form 10-K for the year ended December 26, 2020 and other filings with the Securities and Exchange Commission. As the forward-looking statements are based on Onto Innovation’s current expectations, the Company cannot guarantee any related future results, levels of activity, performance or achievements. Onto Innovation does not assume any obligation to update the forward-looking information contained in this proxy statement.

NOTICE OF 20212024 ANNUAL MEETING OF STOCKHOLDERS

Date: |

| |

Time: |

| |

Place: |

| |

Record Date: | Only stockholders of record at the close of business on March | |

Items of Business: | 1. | To elect the Board’s |

2. | To approve, on an advisory (non-binding) basis, the compensation of our named executive officers as disclosed in this proxy statement; | |

3. | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending | |

4. | To transact such other business as may properly come before the meeting and any adjournment or postponement thereof. | |

These items of business are described more fully below in the accompanyingthis proxy statement. This year we will be providing access to our proxy materials via the internetInternet in accordance with the Securities and Exchange Commission’s “Notice and Access” rules. On or about April 1, 2021,5, 2024, we will be mailing to our stockholders our Notice of Internet Availability of Proxy Materials, to our stockholders, which contains instructions for accessing our 20212024 proxy statement and 20202023 annual report to stockholders and how to vote online. In addition, the Notice of Internet Availability of Proxy Materials containswill contain instructions on how to request a paper copy of the 20212024 proxy statement and 20202023 annual report to stockholders.

Your vote is important. As always, but especially now given the uncertainties posed by the coronavirus (COVID-19) pandemic, we encourage you to vote your shares as soon as possible and prior to the Annual Meeting via the internet or by phone even if you plan to attend the Annual Meeting. Voting early will ensure your shares are represented at the Annual Meeting, regardless of whether you attend the Annual Meeting. You may cast your vote via the internet,Internet, by telephone, by mail or during the Annual Meeting. If you receive a paper copy of the proxy card by mail, you may also mark, sign, date, and return the proxy card promptly in the accompanying postage-prepaid envelope.

* We intend to hold our annual meeting in person. However, we are sensitive to the public health and travel concerns our stockholders may have and recommendations that public health officials have issued in light of the COVID-19 pandemic. As a result, we will require all attendees to comply with certain health and safety protocols, which are described in the proxy statement, and we may decide to hold the meeting in a different location or solely by means of remote communication (i.e., a virtual-only meeting). In such an event, we would announce any such updates in additional proxy materials filed with the Securities and Exchange Commission and in a press release that we would make available on our website at https://investors.ontoinnovation.com. We encourage you to check this website prior to the meeting if you plan to attend.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD MAY 11, 2021:22, 2024:

This notice, the proxy statement, and the 2020 Annual Report2023 annual report to Stockholdersstockholders are available at:

https://www.ontoinnovation.com/ar-proxy

FOR THE BOARD OF DIRECTORS

Robert A. KochYoon Ah E. Oh

Corporate Secretary

Wilmington, Massachusetts

April 1, 20215, 2024

PROXY STATEMENT

PROXY SUMMARYTABLE OF CONTENTS

On October 25, 2019 (the “Merger Date”), Rudolph Technologies, Inc. merged with and into Nanometrics Incorporated, which was then renamed

Page | |

Forward Looking Statements | 1 |

Proxy Summary | 2 |

Onto Innovation Proxy Statement | 5 |

Proposal 1 – Election of Directors | 6 |

Nominees For Director | 6 |

Corporate Governance Principles and Practices | 14 |

Proposal 2 – Advisory Vote to Approve Named Executive Officer Compensation | 27 |

Executive Officer Compensation | 28 |

Compensation Committee Report on Executive Officer Compensation | 48 |

Executive Officer Compensation Tables | 49 |

CEO Pay Ratio | 64 |

Proposal 3 – Ratification of Appointment of Independent Registered Public Accounting Firm | 65 |

Audit Committee Report | 68 |

Executive Officer Biographies | 69 |

Security Ownership of Certain Beneficial Owners | 72 |

Equity Compensation Plan Information | 73 |

Other Matters | 73 |

Questions and Answers About the Annual Meeting | 74 |

Additional Information | 79 |

Forward Looking Statements

Certain statements in this proxy statement of Onto Innovation Inc. (referred to in this proxy statement, together with its consolidated subsidiaries, unless otherwise specified or suggested by the context, as the “Company,” “Onto Innovation,” “we,” “our,” or “us”) may be considered “forward-looking statements” or may be based on “forward-looking statements,” including, but not limited to, those concerning: our business momentum and future growth; technology development, product introduction and acceptance of our products and services; our manufacturing practices and ability to deliver both products and services consistent with our customers’ demands and expectations and to strengthen our market position, including our ability to source components, materials, and equipment due to supply chain delays or shortages; our expectations of the semiconductor market outlook; future revenue, gross profits, research and development and engineering expenses, selling, general and administrative expenses, and cash requirements; the effects of political, economic, legal, and regulatory changes or conflicts on our global operations; the effects of natural disasters or public health emergencies on the global economy and on our customers, suppliers, employees, and business; our dependence on certain significant customers and anticipated trends and developments in and management plans for our business and the markets in which we operate; and our ability to be successful in managing our cost structure and cash expenditures and results of litigation. Statements contained or incorporated by reference in this proxy statement that are not purely historical are forward-looking statements and are subject to safe harbors created under Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended (the “2019 Merger”“Exchange Act”). Unless, and the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by words such as, but not limited to, “anticipate,” “believe,” “continue,” “estimate,” “expect,” “intend,” “plan,” “should,” “may,” “could,” “will,” “would,” “forecast,” “project” and words or phrases of similar meaning, as they relate to our management or us. Forward-looking statements contained herein reflect our current expectations, assumptions and projections with respect to future events and are subject to certain risks, uncertainties and assumptions, such as those identified in Part I, Item 1A. “Risk Factors” of our Form 10-K for the fiscal year ended December 30, 2023. Actual results may differ materially and adversely from those included in such forward-looking statements. Forward-looking statements reflect our position as of the date of this report and we undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, indicated or context otherwise requires,except as used herein “Nanometrics” refers to Nanometrics Incorporated and its subsidiaries prior to the 2019 Merger and “Rudolph” refers to Rudolph Technologies, Inc. and its subsidiaries prior to the 2019 Merger.required by law.

PROXY STATEMENT | 1 |

PROXY SUMMARY

This summary highlights information contained elsewhere in the proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting.

Stockholder Voting Matters |

Voting Matter | Board Vote Recommendation | Page Reference for |

Proposal 1: Election of Directors | FOR ALL |

|

Proposal 2: Advisory Vote | FOR |

|

Proposal 3: Ratification of Appointment of Independent Registered Public Accounting Firm for the Fiscal Year Ending | FOR |

|

|

CORPORATE GOVERNANCE HIGHLIGHTS

Snapshot Ofof Board Composition

The following table presents a snapshot of the expected composition of the Onto Innovation Board of Directors (the “Board” or “Board of Directors”) immediately following the 20212024 Annual Meeting, assuming the election of all nominees named in the proxy statement.

Board Characteristic | Onto Innovation | |

Total Number of Directors |

| |

Percentage of Independent Directors |

| |

Average Age of Directors (years) |

| |

Average Tenure of Directors (years) |

| |

Separate | Yes | |

Independent | Yes | |

Audit Committee | 2 | |

Female Director Representation |

| |

Race/Ethnicity Diversity Representation | 12.5% |

PROXY STATEMENT | 2 |

Snapshot Of Board Governance And Compensation Policies

The following table presents a snapshot of the Onto Innovation Board Governancegovernance and Compensation Policiescompensation policies currently in effect.

Policy | Onto Innovation |

Majority Voting for All Directors | Yes |

Regular Executive Sessions of Independent Directors | Yes |

Annual Board, Committee, and Director Evaluations | Yes |

Risk Oversight by Full Board and Committees | Yes |

Independent Audit, Compensation, and Nominating & Governance Committees | Yes |

Code of Business Conduct and Ethics for Employees and Directors | Yes |

Financial Information Integrity Policy | Yes |

Stock Ownership Requirement for Directors | 3x annual retainer |

Stock Ownership Requirement for CEO | 3x base salary |

Stock Ownership Requirement for other NEOs | 1x base salary |

Stock-Based Award Grant Date Policy | Yes |

Anti-Hedging, Anti-Short Sale & Anti-Pledging | Yes |

Incentive Compensation | Yes |

No | Yes |

No Poison Pill | Yes |

Stock Buyback Program | Yes |

Double Trigger Change-in-Control Provisions for Executive Officers | Yes |

Annual Environmental, Social, and Governance Report | Yes |

PROXY STATEMENT | 3 |

Snapshot Of Board Governance And Compensation Policies Newly Implemented Or Adjusted In Past Year

The following presents a snapshot of the Onto Innovation Board Governancegovernance and Compensation Policiescompensation policies that were newly implemented or adjusted in the past year.

After the 20202023 Annual Meeting of Stockholders, the following actions were taken with regard to the composition and leadership structure of the Board and standing committees of the Board:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AtAs previously disclosed, in March 2024, the 2020 Annual Meeting of Stockholders,Board elected Susan D. Lynch to the Onto Innovation Inc. 2020 Stock PlanBoard and Onto Innovation 2020 Employee Stock Purchase Plan were approved byappointed her to the stockholders.

As previously disclosed, Karen M. Rogge announced her decision to retire from the Board following the conclusion of her current term, which expires at the 2024 Annual Meeting.

RegrettablyNew York Stock Exchange (“NYSE”) that went into effect in January of 2021 one of our Directors, Robert G. Deuster, passed away. Mr. Deuster had served on the Nanometrics Board of Directors (“Nanometrics Board”) since 2017 and continued his service to the Company following the 2019 Merger. His insights and contributions to the Board and the Company will be greatly missed.

The Board determined that, effective as of the 2021 Annual Meeting of Stockholders, the size of the Board would be reduced to seven (7) members.

PROXY STATEMENT | 4 |

__________________________________________

PROXY STATEMENT

__________________________________________

The proxy detailed herein is solicited on behalf of the Board of Directors (the “Board” or “Board of Directors”) of Onto Innovation Inc. (“Onto Innovation,” the “Company,” “we,” “us” or “our”) for use at the 20212024 Annual Meeting of Stockholders to be held May 11, 202122, 2024 at 10:8:00 a.m. EasternPacific Time (the “Annual Meeting”), or at any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Stockholders. The Annual Meeting will be held at the Company’s principal executive offices located at 16 Jonspin Road, Wilmington, Massachusetts 01887.1550 Buckeye Drive, Milpitas, CA 95035. Directions to the annual meetingAnnual Meeting may be found on our website www.ontoinnovation.com(www.ontoinnovation.com) by clicking on “Company,” “Locations,” “Massachusetts”“California” and then accessing the interactive map. The Company’s telephone number is (978) 253-6200.

We intend to hold the Annual Meeting in person. However, we are sensitive to the public health and travel concerns our stockholders may have and recommendations that public health officials have issued in light of the coronavirus (COVID-19) pandemic. As a result, we will require all attendees to comply with certain health and safety protocols, which are described in this proxy statement under “Questions and Answers About the Annual Meeting – What Is Required To Be Admitted To The Annual Meeting?”, and we may decide to hold the meeting in a different location or solely by means of remote communication (i.e., a virtual-only meeting). In such an event, we would announce any such updates in additional proxy materials filed with the SEC and in a press release that would be available on our website at https://investors.ontoinnovation.com. We encourage you to check this website prior to the meeting if you plan to attend.

On or about Thursday, April 1, 2021,5, 2024, we will furnish a Notice of Internet Availability of Proxy Materials (“Notice”) to our stockholders containing instructions on how to access the proxy materials online at:

https://www.ontoinnovation.com/ar-proxy

Instructions on how to vote online and to request a printed copy of the proxy materials may be found in the Notice. If you receivedreceive a Notice by mail, you will not receive a paper copy of the proxy materials unless you request such materials by following the instructions contained in the Notice. Your vote is important, regardless of the extent of your holdings.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

|

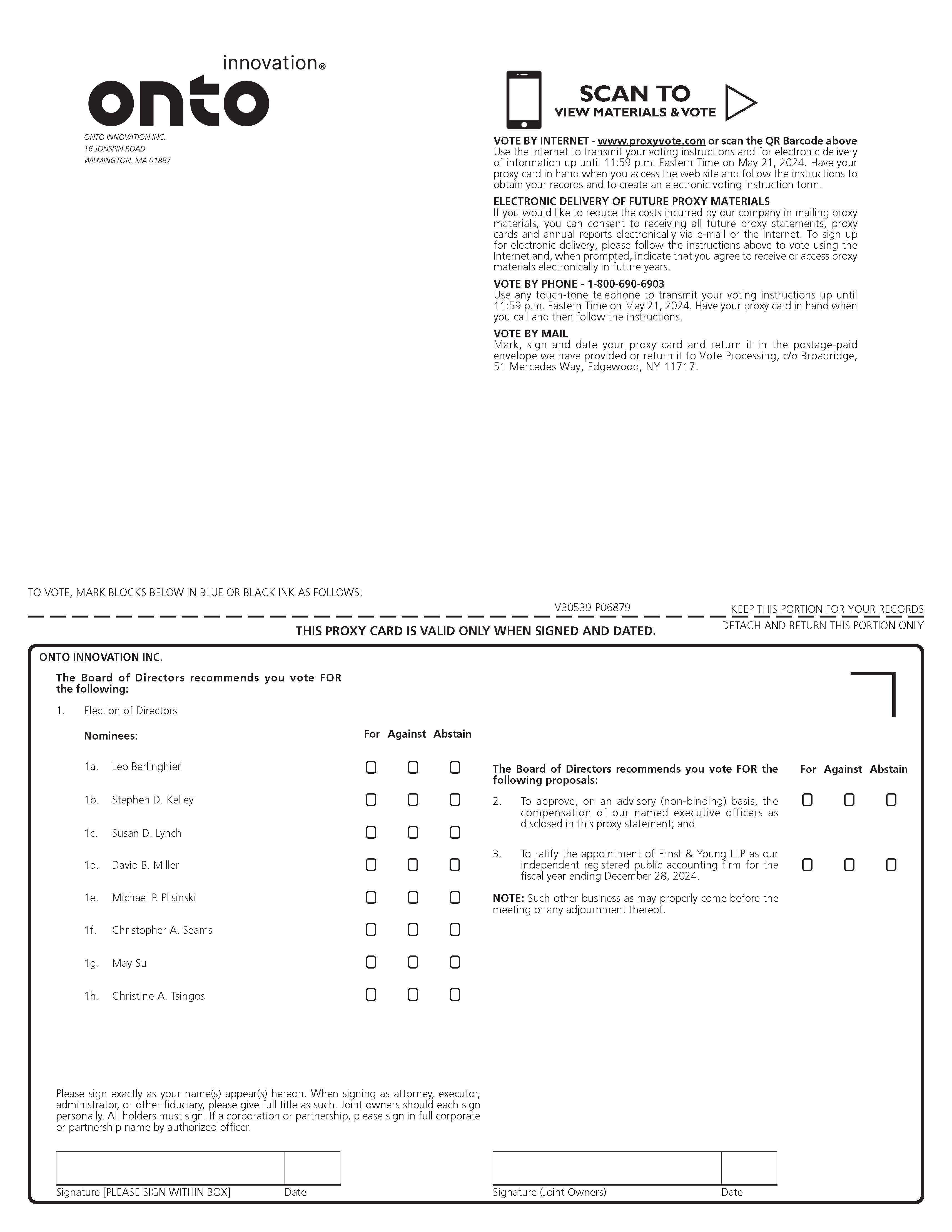

At the Annual Meeting, stockholders will be asked to vote upon the matters set forth in the accompanying Notice of Annual Meeting, including:

the election of seven (7) directors;

an advisory resolution on named executive officer compensation; and

the ratification of the appointment of our independent registered public accounting firm for fiscal 2021,

all of which are more fully described herein.

|

We are not currently aware of any other matters to be presented at the Annual Meeting other than those described in this proxy statement. If any other matters not described in the proxy statement are properly presented at the meeting, any proxies received by us will be voted in the discretion of the proxy holders.

|

If you were a stockholder of record as of the close of business on March 12, 2021, which is referred to in this proxy statement as the “record date,” you are entitled to receive notice of the Annual Meeting and to vote the shares of common stock that you held as of the close of business on the record date. Each stockholder is entitled to one (1) vote for each share of common stock held by such stockholder on the record date.

All stockholders of record as of the record date may attend the Annual Meeting, which will be held at the Company’sOur principal executive offices are located at 16 Jonspin Road, Wilmington, Massachusetts 01887. To obtain directions to attend the Annual Meeting and vote in person, please contact Investor Relations at 978-253-6200. We currently intend to hold the Annual Meeting in person. In the event it is not possible or advisable to hold the Annual Meeting in person, we will announce alternative arrangements for the meeting as promptly as practicable, which may include holding the meeting partially or solely by means of remote communication (i.e., a virtual-only meeting). Please monitor our website at https://investors.ontoinnovation.com for updated information. If you are planning to attend the Annual Meeting, please check the website prior to the Annual Meeting date. As always, we encourage you to vote your shares prior to the Annual Meeting.

| 5 |

If you are a stockholder of record, you will need valid picture identification and proof that you are a stockholder of record of the Company as of the record date to gain admission to the Annual Meeting.

If you are a beneficial holder, you will be required to present a valid picture identification and proof from your bank, broker or other record holder of your shares that you are the beneficial owner of such shares to gain admission to the Annual Meeting. If you are a beneficial holder and wish to vote your shares at the meeting, you will need a legal proxy from your bank, broker or other record holder of your shares.

All attendees will be expected to comply with important health and safety protocols, including wearing an appropriate face covering at all times, hand washing and/or applying hand sanitizer upon arrival, and practicing social distancing by maintaining at least a six-foot distance from other attendees. You should not attend if you feel unwell or if you have been exposed to COVID-19. Additionally, there will be a mandatory health screening and temperature check required for entry to the building. If you have a fever or other symptoms of COVID-19, you will not be permitted to attend the Annual Meeting in person. We reserve the right to take any additional precautionary measures, and may ask attendees to leave the Annual Meeting if they are not following our procedures.

|

The required quorum for the transaction of business at the Annual Meeting is a majority of the issues and outstanding shares of Common Stock of the Company, $0.001 par value per share (“Common Stock”), present in person or by proxy and entitled to vote at the Annual Meeting. On the record date, 48,956,481 shares of the Company’s Common Stock were issued and outstanding, each entitled to one vote on each matter to be acted upon at the Annual Meeting. Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the meeting. Abstentions and broker non-votes will be counted to determine whether there is a quorum present. If a quorum is not present, the Annual Meeting may be adjourned or postponed to a later date.

|

A broker non-vote occurs when a bank, broker or other registered holder of record holds shares for a beneficial owner but is not empowered to vote on a particular proposal on behalf of such beneficial owner because the proposal is considered “non-routine” and the beneficial owner has not provided voting instructions on that proposal. The election of directors and the advisory vote on named executive officer compensation are treated as “non-routine” proposals. This means that if a brokerage firm holds your shares on your behalf, those shares will not be voted with respect to any of these proposals unless you provide instructions to that firm by voting your proxy. See below under “What Is the Vote Required for Election of Directors?” and “What Is the Vote Required for the Approval of Proposals Other Than Director Elections?” for a discussion of the impact of broker non-votes on each of the proposals that will be presented at the Annual Meeting. In order to ensure that any shares held on your behalf by a bank, broker or other registered holder of record are voted in accordance with your wishes,

we encourage you to provide instructions to that firm or organization in accordance with the Notice of voting instruction form provided by the broker, bank or other registered holder or to contact your broker, bank or other registered holder to request a proxy form.

|

The Company will bear the cost of soliciting proxies. In addition, the Company may reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation material to such beneficial owners. Solicitation of proxies by mail may be supplemented by telephone, facsimile, e-mail or other electronic means or personal solicitation by directors, officers or regular employees of the Company. No additional compensation will be paid to such persons for such services. We have engaged The Proxy Advisory Group, LLC to assist in the solicitation of proxies and provide related advice and informational support, for a services fee and the reimbursement of customary disbursements, which are not expected to exceed $10,000 in total.

|

We are distributing the Company’s proxy materials to stockholders of record via the internet in accordance with the “Notice and Access” approach permitted by rules of the Securities and Exchange Commission (“SEC”). This approach benefits the environment, while providing a timely and convenient method of accessing the materials and voting. Accordingly, we have sent you a Notice because the Board of the Company is soliciting your proxy to vote at the 2021 Annual Meeting of Stockholders, including at any adjournments or postponements of the meeting. On or about April 1, 2021, the Company will begin mailing the Notice to all stockholders of record entitled to vote at the annual meeting. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy of the proxy materials and the Company’s 2020 Annual Report may be found in the Notice.

|

If you receive more than one Notice, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on each of the Notices to ensure that all of your shares are voted.

|

You may either vote “For” all the nominees to the Board or you may “Withhold” your vote for any nominee you specify. For each of the other matters to be voted on, you may vote “For” or “Against” or “Abstain” from voting.

|

If you have a stock certificate or hold shares in an account with our transfer agent, you are considered the “stockholder of record” with respect to those shares. You can submit your proxy online by following the instructions on the Notice. You may opt to submit your proxy by requesting a full set of proxy materials be mailed to you and completing and returning the proxy in the postage-paid envelope provided. Stockholders of record may also vote in person at the Annual Meeting. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote in person even if you have already submitted a proxy.

If you are a stockholder of record with shares registered in your name, you can vote by one of the following methods:

In Person - To vote in person, come to the annual meeting and you will receive a ballot when you arrive.

Via the Internet - To submit your proxy by internet, go to www.investorvote.com/ONTO and follow the instructions on the secure website. The deadline for proxy submission via the internet is 11:59 p.m. (EDT) on May 10, 2021.

Via Telephone – To submit your proxy by telephone, call toll free 1-800-652-VOTE (8683) within the United States, US territories and Canada.

By Mail – Stockholders who receive a paper proxy card may complete, sign and date their proxy card and mail it in the pre-addressed postage-paid envelope that accompanies the proxy card. Proxy cards submitted by mail must be received by the Secretary of the Company at the Company’s principal executive offices prior to the time of the Annual Meeting in order for your shares to be voted.

Even if you plan to attend the meeting, we recommend that you submit your proxy in advance so that your shares are represented at the Annual Meeting in the event you are unable to attend the meeting. Each stockholder of record is entitled to one (1) vote for each share of Common Stock owned by such stockholder on all matters presented at the Annual Meeting. Stockholders do not have the right to cumulate their votes in the election of directors.

If you return a signed and dated proxy card but do not indicate how the shares are to be voted, those shares will be voted in accordance with Onto Innovation’s Board’s recommendations. A valid proxy card also authorizes the individuals named therein as proxies to vote your shares in their discretion on any other matters, which, although not described in the proxy statement, are properly presented for action at the Annual Meeting. If you indicate on your proxy card that you wish to “abstain” from voting on an item, your shares will not be voted on that item.

While internet proxy voting is being provided to allow you to submit your proxy online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions, please be aware that you must bear any costs associated with your internet access, such as usage charges from internet access providers and telephone companies.

|

If your shares are held in a stock brokerage account or by a bank or other holder of record, you are considered the “beneficial owner” of shares held in “street name.” In that case, you may receive a separate voting instruction form, or you may need to contact your broker, bank, or other stockholder of record to determine whether you will be able to provide voting instructions electronically via the internet. As the beneficial owner, you have the right to direct your broker, bank or other holder of record on how to vote your shares by submitting voting instructions to such person in accordance with the directions that the entity provides. In the event you are considered the “beneficial owner” of shares held in “street name” and you wish to vote in person at the annual meeting, you must obtain a legal proxy from your broker, bank or another agent. Follow the instructions from your broker or bank included with these proxy materials or contact your broker or bank to request a legal proxy.

|

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before it is voted at the Annual Meeting. If you are a stockholder of record, you may change your vote after submitting your proxy:

If you submitted your proxy by mail – By delivering a written notice of revocation or a duly executed proxy card bearing a later date to the Secretary of the Company at the Company’s principal executive offices prior to the Annual Meeting;

If you submitted your proxy over the internet – By submitting a timely and valid later proxy online at www.investorvote.com/ONTO;

By submitting a timely and valid later proxy by telephone call to 1-800-652-VOTE (8683) within the USA, US territories and Canada; or

By attending the meeting and voting in person.

If you are a beneficial owner of shares, please contact your bank, broker or other holder of record for specific instructions on how to change or revoke your voting instructions.

|

|

If you are a stockholder of record and do not submit a proxy by mailing your proxy card, by telephone, over the internet or by attending the Annual Meeting and voting in person, your shares will not be voted.

|

If you are a beneficial owner and do not instruct your broker, bank, or other agent how to vote your shares, the question of whether your broker or nominee will still be able to vote your shares depends on whether the New York Stock Exchange (“NYSE”) deems the particular proposal to be a “routine” matter. Brokers and nominees can use their discretion to vote “uninstructed��� shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under the rules and interpretations of the NYSE, “non-routine” matters are matters that may substantially affect the rights or

privileges of stockholders, such as mergers, stockholder proposals, elections of directors (even if not contested), executive officer compensation (including any advisory stockholder votes on executive officer compensation and on the frequency of stockholder advisory votes on executive officer compensation), and certain corporate governance proposals, even if management supported. Accordingly, your broker or nominee may not vote your shares on the election of directors and the advisory proposal to approve the named executive officer compensation without your instructions, but may vote your shares on the proposal to ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending January 1, 2022 even in the absence of your instruction.

|

If you return a signed and dated proxy card or otherwise submit a proxy without marking voting selections, your shares will be voted, as applicable, “For” the election of all seven (7) nominees for director, “For” the advisory approval of the named executive officer compensation and “For” the ratification of the appointment of Ernst & Young, LLP as the independent registered public accounting firm of the Company for its fiscal year ending January 1, 2022. If any other matter is properly presented at the meeting, your proxyholder (one of the individuals named on the proxy card) will vote your shares using his or her best judgment.

|

For the election of directors, each director is elected by a majority of the votes cast (except that if the number of nominees exceeds the number of directors to be elected, directors will be elected by a plurality voting standard). This means that in order for a director nominee to be elected to our Board, the number of votes cast “for” a director’s election must exceed the number of votes cast “against” that director’s election (with “abstentions” and “broker non-votes” not counted as a vote cast either “for” or “against” that director’s election, although abstentions and broker non-votes count for the purpose of determining a quorum). Our Amended and Restated Bylaws (“Bylaws”) provide for election of directors by a majority of votes cast in uncontested elections, and our Summary of Corporate Governance Policies provides that any incumbent director nominee in an uncontested election who does not receive an affirmative majority of votes cast must promptly tender such director’s resignation to our Board. Further information regarding the process that will be followed if such an event occurs can be located under the heading “Proposal 1 - Election of Directors.”

|

The proposal to approve, on an advisory basis, the compensation of our named executive officers and the proposal to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending January 1, 2022 each requires the affirmative vote, in person or by proxy, of a majority of the shares present in person or represented by proxy at the meeting and entitled to vote on the matter to be approved. For such proposals, abstentions in effect count as negative votes, because they are shares represented in person or by proxy that are entitled to vote on the matter and not voted in the affirmative. Broker non-votes are not counted as part of the vote total (because they are not considered “entitled to vote” on the matter) and have no effect on the outcome of those proposals.

|

The Company has adopted a procedure approved by the SEC called “householding.” Under this procedure, when multiple stockholders of record share the same address, we may deliver only one (1) Notice to that address unless we have received contrary instructions from one or more of those stockholders. The same procedure may be followed by brokers and other nominees holding shares of our stock in “street name” for more than one (1) beneficial owner with the same address.

If a stockholder holds shares of stock in multiple accounts (e.g., with our transfer agent and/or banks, brokers or other registered stockholders), we may be unable to use the householding procedures and, therefore, that stockholder may receive multiple copies of the Notice. You should follow the instructions on each Notice that you receive in order to vote the shares you hold in different accounts.

A stockholder that shares an address with another stockholder if such household has received only one (1) Notice, may write or call us as specified below:

|

|

|

|

Conversely, a stockholder of record who shares the same address with another stockholder of record may write or call us as specified below to request that a single set of the proxy materials be delivered to that address. Such stockholder requests may be made to our Investor Relations Department either via phone at 978-253-6200 or by mail directed to:

Investor Relations Department

Onto Innovation Inc.

16 Jonspin Road

Wilmington, Massachusetts 01887

If you are a beneficial owner of shares held in street name, please contact your bank, broker or other holder of record regarding such requests.

|

Preliminary voting results will be announced at the Annual Meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four (4) business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four (4) business days after the meeting, we intend to file a Form 8‑K to publish preliminary results and, within four (4) business days after the final results are known to us, file an additional Form 8-K to publish the final results.

|

Stockholders of the Company are entitled to present proposals for consideration at forthcoming stockholder meetings provided that they comply with the proxy rules promulgated by the SEC, if applicable, and the Bylaws of the Company. Stockholders wishing to present a proposal at the Company’s 2022 Annual Meeting of Stockholders must submit such proposal in writing to the Company Secretary at Onto Innovation Inc., 16 Jonspin Road, Wilmington, Massachusetts 01887 no later than December 2, 2021 in accordance with Rule 14a-8 under the Securities Exchange Act of 1934, as amended (“Exchange Act”), if they wish for it to be eligible for inclusion in the proxy statement and form of proxy relating to that meeting. In addition, under the Company’s Bylaws, a stockholder wishing to nominate a director or make a proposal at the 2022 Annual Meeting of Stockholders outside of Exchange Act Rule 14a-8 must submit such nomination or proposal in writing to the Company Secretary at the above address no earlier than January 11, 2022 and no later than February 10, 2022. The Nominating & Governance Committee will also consider qualified director nominees recommended by stockholders. Our process for receiving and evaluating Board member nominations from our stockholders is described below under the caption “Consideration Of Director Nominees.”

You are also advised to review Company’s Bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations.

CORPORATE GOVERNANCE PRINCIPLES AND PRACTICES

Onto Innovation is committed to sound and effective corporate governance practices. Having such principles is essential to running our business efficiently and to maintaining our integrity in the marketplace. The major components of our corporate governance practices are described below.

|

Our Company management is led by Michael P. Plisinski, who has served as our Chief Executive Officer (“CEO”) and a director since the Merger Date and Christopher A. Seams, who is an independent director and has served as the Chairman of the Company’s Board since the Merger Date.

Our Board is currently comprised of one (1) non-independent director, Mr. Plisinski, and eight (8) directors each of whom has been affirmatively determined by our Board to meet the criteria for independence established by the SEC and the NYSE. The independent directors meet periodically in executive session chaired by the Chairman without the CEO or other management present. Furthermore, each director is encouraged to suggest items for the Board agenda and to raise at any Board meeting subjects that are not on the agenda for that meeting.

In accordance with our sound and effective corporate governance practice, the roles of CEO and Chairman of the Board are held by separate individuals, with the independent Chairman of the Board being designated by the Board. The Board believes that, at the current time, the designation of an independent Chairman of the Board facilitates the functioning of the Board, while leaving the CEO responsible for setting the strategic direction for the Company and for the day-to-day leadership and performance of the Company. The independent Chairman of the Board:

Presides at all meetings of the stockholders and the Board at which he or she is present;

Establishes the agenda for each Board meeting;

Sets the schedule and annual agenda, to the extent foreseeable;

Calls and prepares the agenda for and presides over separate executive sessions of the independent directors;

Acts as a liaison between the independent directors and the Company’s management;

Serves as a point of communications with stockholders; and

Performs such other powers and duties as may from time to time be assigned by the Board or as may be prescribed by the Company’s Bylaws.

|

Each director nominee attended at least 75% of the aggregate of the total number of Board meetings and total number of meetings of Board committees on which such director served during the time such director served on the Board or committees. Timothy J. Stultz, Ph.D. attended 67% of the Board meetings held during 2020 until the Company’s 2020 Annual Meeting date in which Dr. Stultz did not stand for reelection to the Board. While the Company does not currently have a formal policy regarding the attendance of directors at the annual meeting of stockholders, directors are encouraged to attend. All members of the Board attended the Company’s 2020 Annual Meeting of Stockholders.

On five (5) occasions during 2020, the Company’s Board met in executive session in which only the independent Board members were present.

|

The Board makes an annual determination as to the independence of each of our Board members under the current standards for “independence” established by the NYSE and the SEC. The Board has determined that the following nominees for election as directors to our Board are independent under the NYSE Corporate Governance Rules: Leo Berlinghieri, Edward J. Brown, Jr., David B. Miller, Bruce C. Rhine, Christopher A. Seams and Christine A. Tsingos. Michael P. Plisinski, due to his position as our CEO, is not considered to be independent. The two (2) directors not standing for re-election in 2021, Jeffrey A. Aukerman and Vita A. Cassese are both considered to be independent.

From July 2006 to February 2008, Mr. Rhine served as Nanometrics Chief Strategy Officer, and from March 2007 to August 2007, Mr. Rhine served as Nanometrics Chief Executive Officer. Prior to the 2019 Merger, the Nanometrics Board determined

9

��

that Mr. Rhine became an independent member of the Board effective February 2011 under the Nasdaq Listing Rules due to the passage of time subsequent to his previous management role with Nanometrics and this designation was confirmed under the NYSE Listing Rules by the Company Board.

During 2020, none of the independent members of our Board was a party to any transactions, relationships or arrangements that were considered by the Board to impair his or her independence.

|

One of the Board’s primary responsibilities is reviewing the Company’s strategic plans and objectives, including oversight of the principal risk exposures of the Company. In particular, the Board is responsible for monitoring and assessing strategic risk exposure, including a determination of the nature and level of risk appropriate for the Company. The Board does not have a standing risk management committee, but rather administers this oversight function directly through the Board as a whole, as well as through various Board standing committees that address risks inherent in their respective areas of oversight. The Audit Committee assists the Board in oversight and monitoring of the legal and financial risks facing the Company, management's approach to addressing these risks and strategies for risk mitigation, and serves as the contact point for employees to report corporate compliance issues. On at least an annual basis, the Audit Committee reviews and discusses with management policies and systems pursuant to which management addresses risk, including risks associated with our audit, financial reporting, internal control, disclosure control, cybersecurity, legal and regulatory compliance, and investment policies. Our Audit Committee regularly reviews with our Board any issues that arise in connection with such topics and, in accordance with our Summary of Corporate Governance Guidelines, our full Board regularly engages in discussions of risk management to assess major risks facing our Company and review options for the mitigation of such risks. Our Compensation Committee periodically reviews our compensation programs to ensure that they do not encourage excessive risk-taking and our Nominating & Governance Committee oversees risks related to governance issues, such as succession planning. As a result of the foregoing, we believe that our CEO, together with the Chairman of our Audit Committee and our full Board, provides effective oversight of the Company’s risk management function.

|

The Board has three standing committees with separate chairs - the Audit, Compensation, and Nominating & Governance Committees. Each of the Board committees is comprised solely of independent directors. The Audit Committee, Compensation Committee and Nominating & Governance Committee have each adopted a written charter that sets forth the specific responsibilities and qualifications for membership on the committee. The charters of each of these committees are available on our website at https://investors.ontoinnovation.com/governance/governance-documents/.

In 2020, the composition of and number of meetings held by the Company’s Board committees were as follows:

|

|

| |

| |||

|

|

| |

| |||

|

|

| |

| |||

|

|

| |

|

|

|

|

|

The Audit Committee assists the Board in fulfilling its responsibilities for general oversight of the integrity of our financial statements, our accounting policies and procedures and our compliance with legal and regulatory requirements. Among its functions, the Audit Committee is responsible for:

The appointment, compensation, retention and oversight of the Company’s independent registered public accounting firm;

The approval of services performed by the Company’s independent registered public accounting firm;

Reviewing the responsibilities, functions and performance of the Company’s internal audit function;

Reviewing the scope and results of internal audits and ongoing assessments of the Company’s risk management processes;

Monitoring possible transactions between the Company and our officers and directors for any potential conflicts of interest; and

Evaluating the Company’s system of internal control over financial reporting and disclosure controls and procedures.

The report of our Audit Committee is found below under the caption “Audit Committee Report.”

The Board has determined that each of the Audit Committee members meet the Audit Committee membership requirements set forth by the NYSE and the SEC, including that they be “independent.” Furthermore, the Board has determined that Ms. Tsingos qualifies as an “Audit Committee Financial Expert” as that term is defined under SEC rules.

|

The Compensation Committee is responsible for the establishment of the policies upon which compensation of and incentives for the Company’s executive officers will be based, the review and recommendation for approval by the independent members of the Board of the compensation of the Company’s executive officers, and the administration of the Company’s equity compensation plans.

In general, the Compensation Committee reviews and recommends for approval by the independent members of the Board the Company’s compensation policies and practices, including executive officer salary levels and variable compensation programs, both cash-based and equity-based, benefits, severance and equity-based and other compensation plans, policies and programs. With respect to the compensation of the Company’s CEO, the Compensation Committee reviews and recommends for approval by the independent members of the Board the various elements of the CEO’s compensation. With respect to other executive officers, including each of our named executive officers (“NEOs”), the Compensation Committee reviews the recommendations for compensation for such individuals presented to the Compensation Committee by the CEO and the reasons therefor and, in its discretion, may modify the compensation packages for any such individuals. The Compensation Committee has delegated to the Company’s CEO the authority, within certain parameters, to approve the grant of restricted stock units (“RSUs”) to employees and consultants who are not executive officers for purposes of Section 16 of the Exchange Act and hold positions below the level of vice president. All such grants are thereafter reviewed and ratified by the Compensation Committee.

In accordance with its charter, the Compensation Committee may form and delegate its authority to subcommittees when appropriate. Further, the Compensation Committee has the authority to retain, and to terminate, any compensation consultants or other advisors to assist in the evaluation of director, CEO or executive officer compensation or other matters within the scope of the Compensation Committee’s responsibilities and is directly responsible for the appointment, compensation and oversight of such consultants and other advisors, including their fees and other retention terms. From time to time, the Compensation Committee engages the services of such outside compensation consultants to provide advice on compensation plans and issues related to the Company’s executive officer and non-executive officer employees. In 2020, the Compensation Committee engaged Compensia, Inc. (“Compensia”) to provide such assistance to the Compensation Committee. The Compensation Committee also has authority to obtain advice and assistance from internal or external legal, accounting and other advisors.

Each current member of our Compensation Committee is an “outside” director as defined in Section 162(m) of the Internal Revenue Code of 1986, as amended (“IRC”), and a “non-employee” director within the meaning of Rule 16b-3 under the Exchange Act. The Board has determined that each of the Compensation Committee members meet the Compensation Committee membership requirements set forth by the NYSE and the SEC, including that they be “independent.”

For further discussion of the Compensation Committee and its processes and procedures, please refer to the “Compensation Program Objectives, Design and Practices” section in the Compensation Discussion and Analysis below. The Compensation Committee Report is included under the caption “Compensation Committee Report on Executive Officer Compensation” in this Proxy Statement.

|

The responsibilities of the Nominating & Governance Committee include:

Identifying prospective director nominees and recommending to the Board director nominees for the next annual meeting of stockholders and replacements of a director in the event of a vacancy on the Board;

Recommending to the Board the appointment of directors to Board committees;

Developing and recommending to the Board, and monitoring compliance with, the corporate governance principles and standards applicable to the Company;

Managing the CEO selection process; and

Together with our CEO, overseeing our Company’s management succession planning.

The Nominating & Governance Committee also oversees the annual evaluation of the Board, the committees of the Board and the individual directors. In 2020, the Nominating & Governance Committee engaged Spencer Stuart, a global executive search and leadership consulting firm, to provide assistance to the Nominating & Governance Committee in the evaluation of the Board. Typically, this evaluation is performed during the first quarter by each of the directors and reflects an assessment of the Board, the Committees of the Board and each individual director in the prior year. Among other topics, the evaluation in general assesses:

For both the Board and the committees:

|

|

|

|

|

|

For each individual director:

|

|

|

|

|

|

|

|

In addition, the Board reviews the issues faced during the past year, assesses its response and makes determinations whether additional resources or approaches might be applied to further optimize the handling of the issues. The goal of the evaluation is to identify and address any performance issues at the Board, committee or individual level, should they exist, identify potential gaps in the boardroom and to assure the maintenance of an appropriate mix of director skills and qualifications. Upon completion of the evaluation, the Nominating & Governance Committee provides feedback to the Board, the committees and the individual directors regarding the results of the evaluation and raises any issues that have been identified which may need to be addressed.

The Nominating & Governance Committee utilizes a variety of methods for identifying and evaluating nominees and for 2021, utilized the services of Spencer Stuart to assist in this process. Its general policy is to assess the appropriate size and needs of the Board and whether any vacancies are expected due to retirement or otherwise. In addition, candidates for director nominees are typically reviewed in the context of the current composition of the Board, the operating requirements of the Company, the current needs of the Board, and the long-term interests of stockholders, with the goal of maintaining a balance of knowledge, experience and capability. In the event those vacancies are anticipated, or otherwise arise, the Nominating & Governance Committee will consider recommending various potential candidates to fill such vacancies. Candidates may come to the attention of the Nominating & Governance Committee through its current members, stockholders or other persons.

The Board has determined that each of the Nominating & Governance Committee members meets the Nominating & Governance Committee membership requirements, including the independence requirements of the NYSE.

|

Our Board may from time to time establish other special or standing committees to facilitate the management of the Company or to discharge specific duties delegated to the committee by the full Board.

|

In 2020, no member serving on the Compensation Committee (Edward J Brown, Jr., Jeffrey A. Aukerman, Leo Berlinghieri, Robert G. Deuster, David B. Miller) at any time during the year had any form of interlocking relationship as described in Item 407(e)(4) of Regulation S-K with the Company. Further, no member of the Compensation Committee as currently constituted in 2021 (Edward J Brown, Jr., Jeffrey A. Aukerman, David B. Miller) has any form of interlocking relationship as described in Item 407(e)(4) of Regulation S-K as of the date of this proxy statement.

|

The Nominating & Governance Committee of the Board determines the required selection criteria and qualifications of director nominees based upon the needs of the Company at the time nominees are considered. While the Nominating & Governance Committee has no specific minimum qualifications for director candidates, persons considered for nomination to the Board must demonstrate the following qualifications to be recommended by the Nominating & Governance Committee for election:

The candidate must exhibit proven leadership capabilities, high integrity and experience with a high level of responsibilities within his or her chosen field;

The candidate must possess the ability to apply good business judgment and be of sound mind and high moral character;

The candidate must have no personal or financial interest that would conflict or appear to conflict with the interests of the Company;

The candidate must be in a position to properly exercise his or her duties of loyalty and be willing and able to commit the necessary time for Board and committee service; and

The candidate must have the ability to grasp complex principles of business, finance, international transactions and semiconductor inspection, metrology, lithography and related software technologies.

The Nominating & Governance Committee retains the right to modify these qualifications from time to time.

The Nominating & Governance Committee has not adopted a formal diversity policy with regard to the selection of director nominees. Diversity is one of the factors that the Nominating & Governance Committee considers in identifying nominees for director. In selecting director nominees, the Nominating & Governance Committee considers, among other factors:

The competencies and skills that the candidate possesses and the candidate’s areas of qualification and expertise that would enhance the composition of the Board and further its ability to offer advice and guidance to management;

How the candidate would contribute to the Board’s overall balance of expertise, perspectives, backgrounds and experiences in substantive matters pertaining to the Company’s business; and

The candidate’s demonstrated excellence in his or her field and commitment to rigorously representing the long-term interests of the Company’s stockholders.

In its identification of director nominees, the Nominating & Governance Committee will consider how the candidate would contribute to the Board’s overall balance of diversity of expertise, perspectives, backgrounds and experiences in substantive matters pertaining to the Company’s business. When current Board members are considered for nomination for reelection, the Nominating & Governance Committee also takes into consideration their prior contributions to and performance on the Board and their record of attendance.

The Nominating & Governance Committee will consider the above criteria for nominees identified by the Nominating & Governance Committee itself, by stockholders, or through some other source. The Nominating & Governance Committee uses the same process for evaluating all nominees, regardless of the original source of nomination. The Nominating & Governance Committee may use the services of a third-party search firm to assist in the identification or evaluation of Board member candidates.

|

The Nominating & Governance Committee has a formal policy with regard to consideration of director candidates recommended by the Company’s stockholders, the Director Candidate Policy, which may be found on our website at:

https://investors.ontoinnovation.com/governance/governance-documents/

In accordance with the policy, the Nominating & Governance Committee will consider recommendations for candidates to the Board from stockholders of the Company holding no less than 1% of the Company’s securities for at least twelve (12) months prior to the date of the submission of the recommendation. Stockholders wishing to recommend persons for consideration by the Nominating & Governance Committee as nominees for election to the Company’s Board can do so by writing to the Office of the General Counsel of the Company at its principal executive offices giving:

Candidate’s name, age, business address and residence address;

Candidate’s detailed biographical data and qualifications including his/her principal occupation and employment history;

The class and number of shares of the Company which are beneficially owned by the candidate;

The candidate’s written consent to being named as a nominee and to serving as a director, if elected;

Information regarding any relationship between the candidate and the Company in the last three (3) years;

Any other information relating to the candidate that is required by law to be disclosed in solicitations of proxies for election of directors;

The name and address of the recommending or nominating stockholder;

The class and number of shares of the Company which are beneficially owned by the recommending or nominating stockholder;

A description of all arrangements or understandings between such stockholder and each nominee and any other person or persons (naming such person or persons) relating to the nomination; and

Any other information specified under Section 2.5 of the Company’s Bylaws.

|

Our Board adopted corporate governance guidelines, a copy of which is available on our website under “Corporate Governance Summary” at:

https://investors.ontoinnovation.com/governance/governance-documents/

|

We have adopted a Code of Business Conduct and Ethics (applicable to all employees, executive officers and directors) and a Financial Information Integrity Policy (applicable to our financial officers, including our CEO and Chief Financial Officer (“CFO”)) that set forth principles to guide all employees, executive officers and directors and establish procedures for reporting any violations of these principles. Copies of the Code of Business Conduct and Ethics and the Financial Information Integrity Policy may be found on our website at:

https://investors.ontoinnovation.com/governance/governance-documents/

or may be requested by writing to:

Onto Innovation Inc.

Attention: Investor Relations

16 Jonspin Road

Wilmington, Massachusetts 01887

The Company will disclose any amendment to the Code of Business Conduct and Ethics and any waiver of a provision thereof applicable to its officers or directors, including the name of the officer or director to whom the waiver was granted, on our website at www.ontoinnovation.com, on the Investors page.

|

Our Company recognizes the importance of environmental and social responsibility programs in the advancement of our Company’s corporate mission and the delivering of value to our stakeholders. Consistent with our established core values of Passion, Integrity, Collaboration and Results, we are committed to upholding the highest levels of integrity and are dedicated to working with our stockholders to drive and improve our environmental, social and governance (“ESG”) initiatives and outcomes across our Company.

Environmental: Our Company strives to improve our operations and minimize our impact on the environment. Our commitment to sustainability requires a sound strategy and a broad portfolio of efforts. We realize that our strategy and efforts need to continuously improve in order for us to excel in an increasingly resource-constrained world. To this end, our Company has endeavored to monitor and manage our environmental impact across our business. We have established goals in order to minimize adverse effects on the community, protect natural resources and to manage our energy efficiency and impact on greenhouse gas emissions, water conservation and waste reduction. We also strive to protect the health and safety of our team members whether they are working at our offices, manufacturing facilities or in the field at our customer’s locations.

Quality: Our Company demands excellence in our quality and environmental performance, as demonstrated through our product and process qualification commitments, which resulted in our ISO 9001 Quality Management certification. It is our intent that each of our employees be accountable for driving quality in all that they do and seek continual improvement in order to meet or exceed our customers’ needs and expectations. In addition, our products and solutions are designed to meet or exceed safety requirements and reflect energy efficiency features in order to confer benefits to our customers and the environment. We also produce our systems responsibly and offer tool trade-ins, refurbishments and technology upgrade programs in order to help assure that our customers receive the optimal value from our products with a potentially lower environmental impact.

Social. It is our Company’s goal to provide a work environment that encourages a diverse and motivated workforce in order that employees may achieve their full potential. Our commitment is to ensure that our work environment reflects fair treatment and equal opportunity and is free from unlawful discrimination. We seek the development of our talent, both from a personal and professional perspective, in order to assure that they are afforded the opportunity to advance their careers and personal well-being. And during the COVID-19 pandemic, we have implemented numerous practices and policies to help ensure the continued health, safety, and well-being of our employees.

We also believe in giving back to our community. Our Company engages in service projects in our communities globally, established a charitable giving program which includes corporate matching for employee donations to qualified nonprofit organizations as well as engaged in mentoring of students looking to pursue science, technology, engineering and math, or “STEM,” careers. With the COVID-19 pandemic, we donated face masks and other items to our worldwide communities in order to help provide both short-term assistance and support the longer-term recovery. We believe that these efforts help to advance the involvement of our employees and our Company in the various communities in which we operate and hopefully make a difference.

Governance. Our Company is committed to ethical and sustainable business practices. Our Code of Busines Conduct and Ethics underpins and guides these efforts. As ESG goals and objectives are proposed, they are reviewed and set by the ESG management team, who then measures the progress made toward achieving such goals on a quarterly basis. In addition, our ESG management team meets periodically with the Board to appraise it of the ESG strategy, ensure alignment on plans and goals, and report on the ongoing progress toward these goals.

We encourage you to review our 2020 Interim Corporate Social Responsibility Report and 2020 Annual Corporate Social Responsibility Report (located on our website at https://ontoinnovation.com/company/corporate-social-responsibility) for more detailed information regarding our ESG initiatives. Nothing on our website, including our Corporate Social Responsibility Reports or sections thereof, is deemed incorporated by reference into this proxy statement or other filings with the SEC, and the information contained on our website is not part of this document.

|

There have been no “related person transactions” since the beginning of 2020 to present, nor are there any currently proposed “related person transactions,” involving any director, director nominee or executive officer of the Company, any known 5% stockholder of the Company or any immediate family member of any of the foregoing persons (which are referred to together as “related persons”). A “related person transaction” generally means a transaction involving more than $120,000 in which the Company (including any of its subsidiaries) is a participant and in which a related person has a direct or indirect material interest.

The Board has adopted policies addressing the Company’s procedures with respect to the review, approval and ratification of “related person transactions” that are required to be disclosed pursuant to Item 404(a) of Regulation S-K. Our related person practices and policies ensure that our directors, officers and employees are proactively screened from any conflicts of interests interfering with their obligations to the Company. Our policies are included in our corporate governance documents, including our Code of Business Conduct and Ethics, the Audit Committee Charter and Summary of Corporate Governance Policies, each of which is available on the Investors section of our website located at:

https://investors.ontoinnovation.com/governance/governance-documents/

Pursuant to our Code of Business Conduct and Ethics, our directors, officers and employees are required to avoid any actual or apparent conflicts of interest (other than conflicts of interest that have received appropriate approval as described below), which includes taking actions or having interests that may interfere with the objective or efficient performance of such person’s duties to the Company or that may result in such person receiving improper personal benefits as a result of their position with the Company.

Pursuant to our Summary of Corporate Governance Policies, if a director becomes involved in any activity or interest that may result in an actual or potential conflict (or the appearance of a conflict) with the interests of the Company, that director is required to disclose such information promptly to the Board, which will determine an appropriate resolution on a case-by-case basis. This policy further reflects that all directors must recuse themselves from any discussion or decision affecting their personal, business or professional interests. Similarly, our Board will determine the appropriate resolution of any actual or potential conflict of interest involving our CEO and our CEO will determine the appropriate resolution of any conflict-of-interest issue involving any other officer of the Company. When necessary and appropriate, resolution of such issues may require consideration of the matter by the Audit Committee.

Pursuant to both the Board’s Summary of Corporate Governance Policies and the Audit Committee Charter, the Audit Committee, which consists entirely of independent directors, will review any proposed transaction in which the Company or its subsidiaries are to participate if the amount involved in the transaction exceeds $120,000 and we are aware that any related person may have a direct or indirect material interest in the transaction. The Audit Committee will consider the facts and circumstances and will approve or ratify a proposed transaction if the Audit Committee considers it appropriate and believes that such transaction will serve the long-term interests of our stockholders. The Compensation Committee of the Board reviews and recommends to the Board for approval compensation decisions for Board members and our executive officers (and such other employees of the Company as directed by the Board) pursuant to the Compensation Committee Charter.

|

We have a formal policy regarding communications with the Board, our Stockholder & Interested Party Communications Policy, which is found on our website at https://investors.ontoinnovation.com/governance/governance-documents/.

Stockholders may communicate with the Board, any of the Company’s Board committees (Audit, Compensation or Nominating & Governance) or any of the Company’s directors by writing to:

Onto Innovation Inc.

Office of the General Counsel

550 Clark Drive

Budd Lake, New Jersey 07828

and such communications will be forwarded to the intended recipient(s) to the extent appropriate. Prior to forwarding any communication, the General Counsel will review it and, in his or her discretion, will not forward a communication deemed to be of a commercial nature or otherwise inappropriate.

ELECTION OF DIRECTORS

|

The Board currently has nine (9) members. Effective as of the conclusion of the 2021 Annual Meeting of Stockholders, the authorized number of directors for the Board shall be reduced to seven (7) members. All current directors are standing for election at the Annual Meeting with the exception of Jeffrey A. Aukerman and Vita A. Cassese.

Nominees

The Company’s Amended and Restated Certificate of Incorporation (“Charter”) provides that directors shall be elected at each annual meetingAnnual Meeting of stockholders,Stockholders, and that each director of the Company shall be elected to hold office, and shall serve until the expiration of the term for which he or she is elected and until his or her successor is duly elected and qualified, or until his or her earlier death, resignation, disqualification or removal; except that if any such election shall not be so held, such election shall take place at a stockholders' meeting called and held in accordance with the DGCL.removal.

Based on the recommendation of the Nominating & Governance Committee, the seven (7)eight director nominees approved by the Board for inclusion in this proxy statement and for election at the Annual Meeting are:

Leo Michael P. Plisinski

|

Each nominee is currently serving as a director of Onto Innovation. In making its recommendations, the Nominating & Governance Committee considered a number of factors, including its criteria for Board membership, which include the qualifications that must be possessed by a director candidate in order to be nominated for a position on our Board. Each nominee has indicated that he or she will serve if elected. Unless otherwise instructed, the proxy holders will vote the proxies received by them for the Company’s seven (7)eight nominees. In the event that any nominee of the Company becomes unable or unavailable to serve as a director at the time of the Annual Meeting (which we do not anticipate), the proxy holders will vote the proxies for any substitute nominee who is designated by the current Board to fill the vacancy. Alternatively, the Board, in its discretion, may elect not to nominate a substitute and to reduce the numbersize of directors serving on the Board. We do not have any reason to believe that any of the nominees will be unable or will decline to serve as a director.

Board Composition and Refreshment

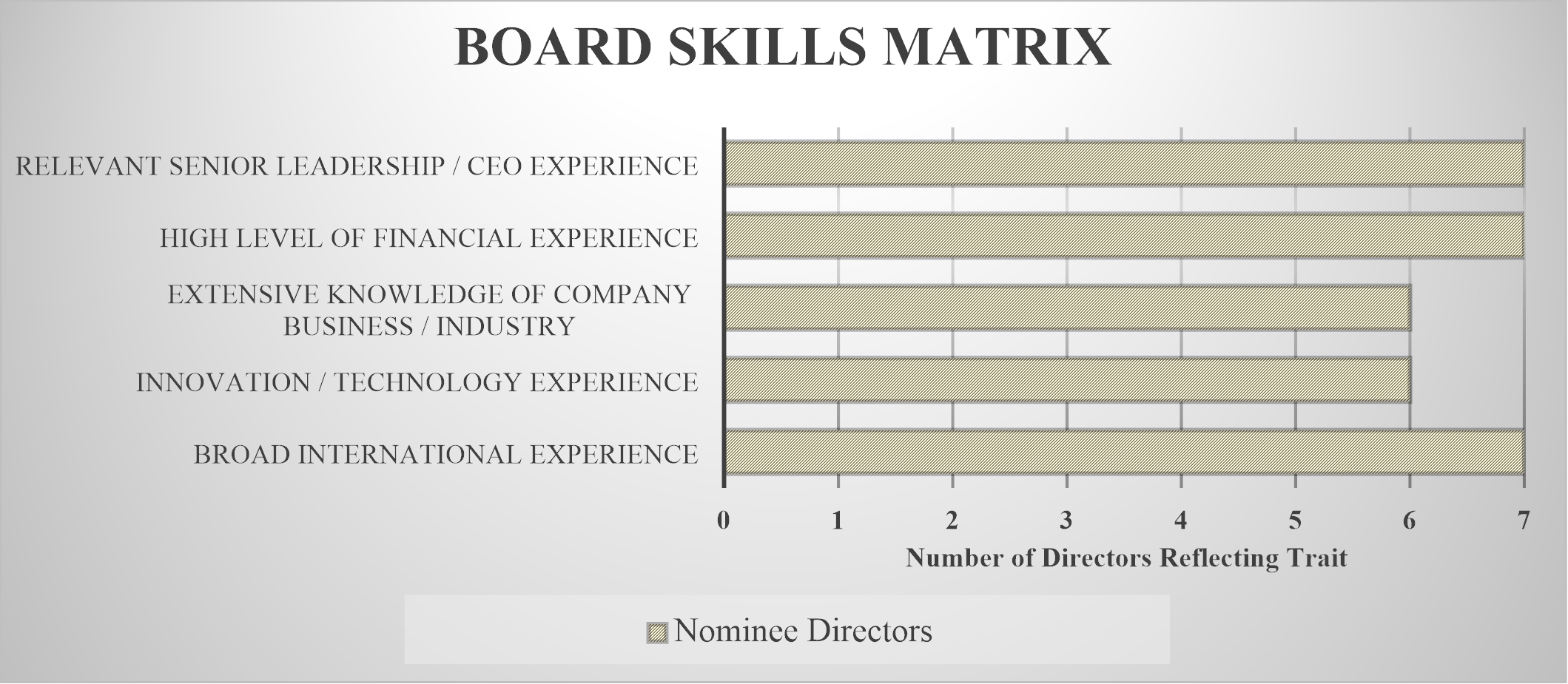

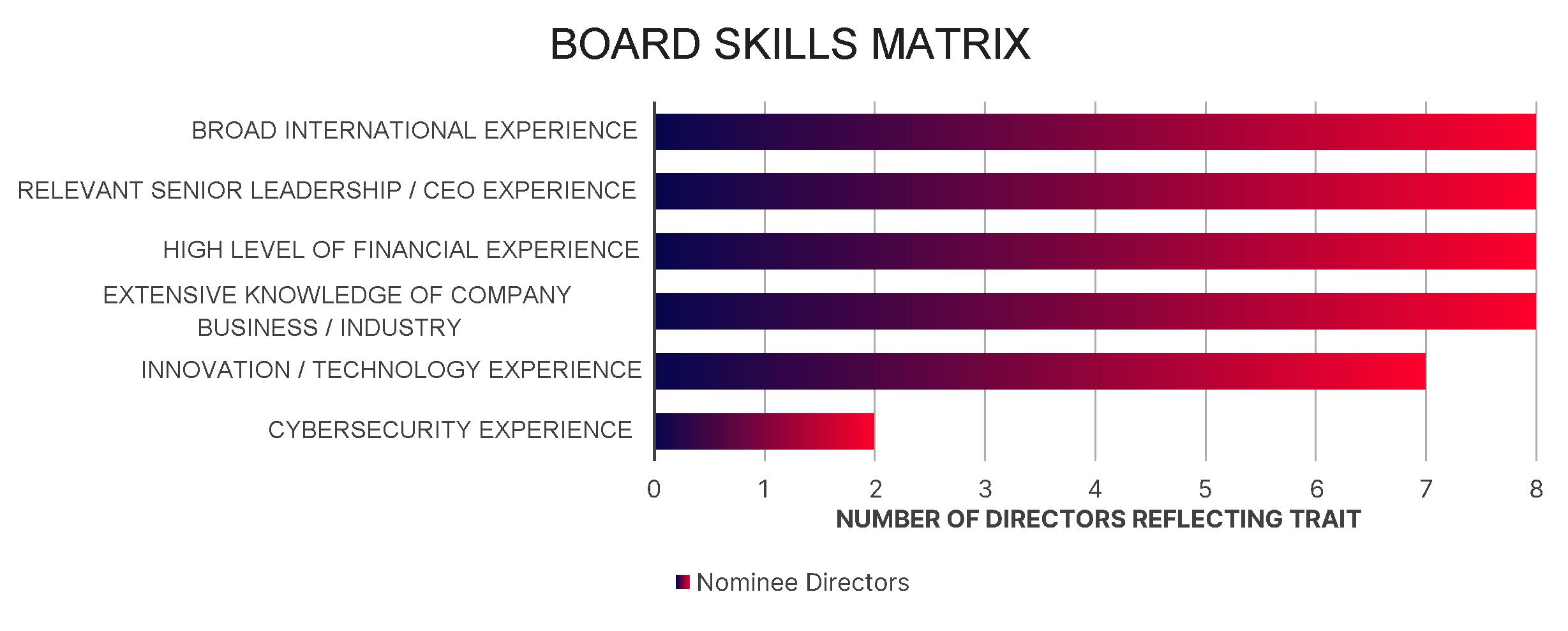

|

A priority of the Nominating & Governance Committee and the Board as a whole is making certain that the composition of the Board reflects the desired professional experience, skills, and backgrounds in order to present an array of viewpoints and perspectives, help develop and execute strategy for the future, and effectively represent the long-term interests of stockholders. Further, the Board recognizes the importance of Board refreshment in order to continue to achieve an appropriate balance of tenure, turnover, diversity, and skills on the Board.

Vote Required

|

Pursuant to the Company’s Amended and Restated Bylaws (“Bylaws”), our directors are elected by the affirmative vote of the majority of the votes cast (provided, however, that if the number of nominees exceeds the number of directors to be elected, directors will be elected by a plurality voting standard). In order for a director in an uncontested election to be elected, the number of votes cast “for” his/her election must exceed the number of votes cast “against” his/her election (with “abstentions” and “broker non-votes” not counted as a vote cast either “for” or “against” that director’s election). If a nominee who is an incumbent director in an uncontested election receives a greater number of “Withhold”“against” votes for election than “For”“for” votes in an uncontested election and is not elected, our Summary of Corporate Governance Policies providesGuidelines provide that such director must promptly tender a resignation to the Board. Our Nominating & Governance Committee would then make a recommendation to the Board on whether to accept or reject the tendered resignation, or whether other action should be taken. Within ninety (90)90 days after the date of the certification of the election results, our Board will act on any such tendered resignation and publicly disclose (in a press release, a filing with the SEC, or other broadly disseminated means of communication) its decision regarding the tendered resignation and the rationale behind the decision.

| 6 |

Information about the Nominees and Continuing Directors

Our Board and its Nominating & Governance Committee believe that all of the directors anddirector nominees are highly qualified, and have demonstrated leadership skills, and have the requisite experience and judgment in areas that are relevant to our business. We believe that their ability to challenge and stimulate management and their dedication to the affairs of the Company collectively serve the interests of the Company and its stockholders. The Company is unaware of any arrangements or understandings between any director or nominee and any other person(s) pursuant to which any director or nominee was or is to be selected.

The seven (7)eight nominees for director are set forth below. All information is as of the record date.

Name |

| Board Tenure | ||||

| (1) | |||||

Leo Berlinghieri | Former President and Chief Executive Officer of MKS Instruments, Inc. | 15.5 years | ||||

Stephen D. Kelley | President and Chief Executive Officer of Advanced Energy Industries, Inc. | 1.2 years | ||||

Susan D. Lynch | Former Senior Vice President and Chief Financial Officer of V2X, Inc. | <0.1 years | ||||

David B. Miller | Former President of DuPont Electronics & Communications | 8.7 years | ||||

Michael P. Plisinski | Chief Executive Officer of Onto Innovation Inc. | 8.4 years | ||||

Christopher A. Seams | Former Chief Executive Officer | 8.7 years |

| |||

| Former |

| ||||

| Chief Executive Officer | 2.1 years |

| |||

|

|

| ||||

|

|

| ||||

|

|

| ||||

Christine A. Tsingos | Former Executive Vice President and |

| ||||

|

|